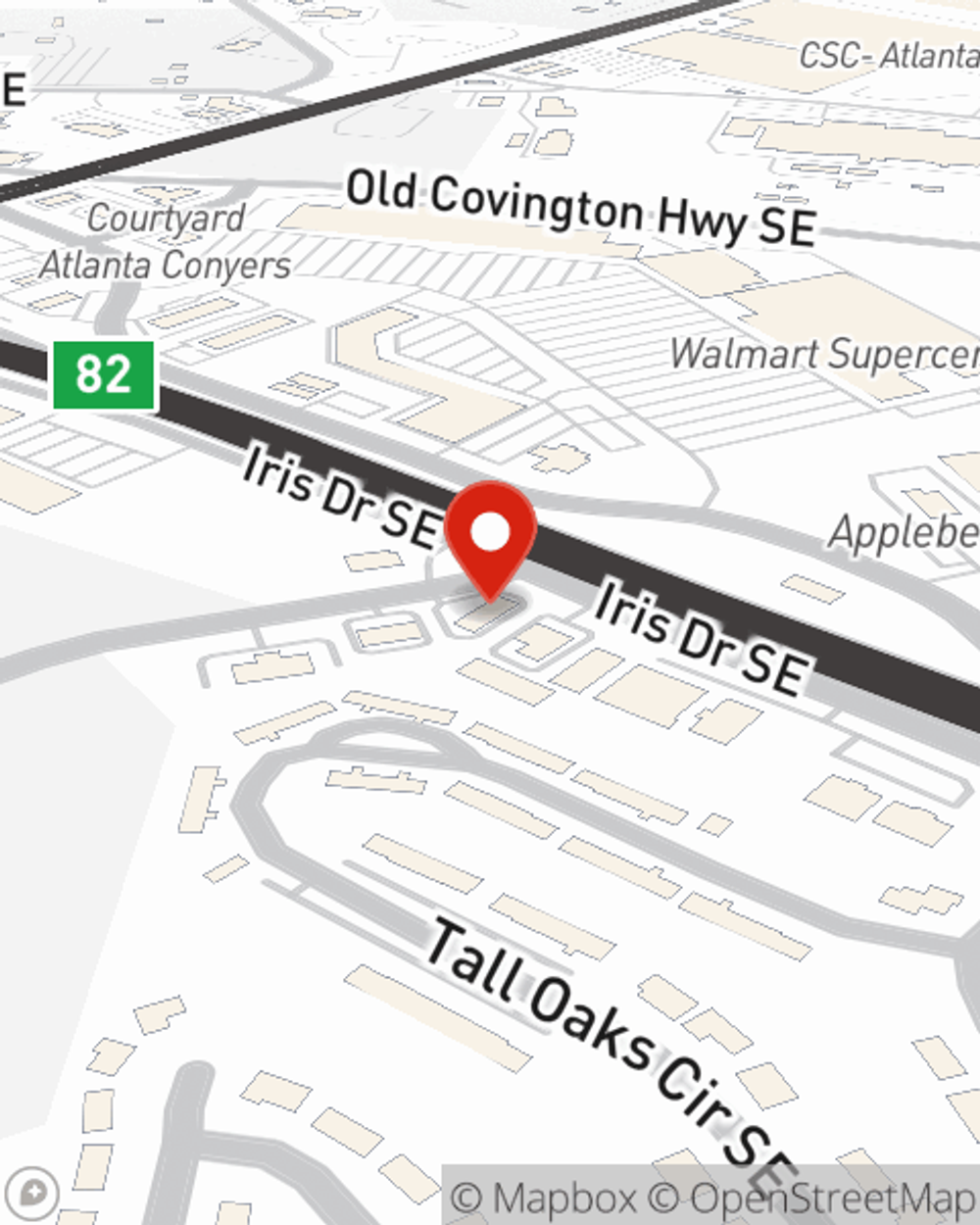

Condo Insurance in and around Conyers

Unlock great condo insurance in Conyers

Quality coverage for your condo and belongings inside

Home Is Where Your Heart Is

When looking for the right condo, it's understandable to be focused on details like location and home layout, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Unlock great condo insurance in Conyers

Quality coverage for your condo and belongings inside

Protect Your Home Sweet Home

With this protection from State Farm, you don't have to be afraid of the unforeseen happening to your biggest asset. Agent Todd Shambo can help lay out all the various options for you to consider, and will assist you in building a dependable policy that's right for you.

Want to learn more about the State Farm insurance options that may be right for you and your condominium? Simply reach out to agent Todd Shambo's team today!

Have More Questions About Condo Unitowners Insurance?

Call Todd at (770) 922-2084 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Todd Shambo

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.